DORA - Digital Operational Resilience Act

Enhancing Operational Resilience in the EU Financial Sector

As digitalization advances, the financial sector faces increased cyber threats, necessitating robust resilience strategies. The Digital Operational Resilience Act (DORA) - Regulation (EU) 2022/2554 is a comprehensive framework aimed at strengthening the cybersecurity and operational resilience of the financial sector within the European Union.

Looking for a hands-on guide?

Check out our guide Implementing Supplier Transparency.

This guide provides a structured approach, aligning with the needs of enterprise-level operations and compliance requirements.

DORA: A Comprehensive Framework

DORA establishes a unified set of standards for digital operational resilience, ensuring that all financial entities within the EU can effectively mitigate cyber risks.

Key Aspects of DORA

DORA covers several critical areas to enhance the digital resilience of financial entities.

- Broad Application: Applies to a wide range of financial entities, including banks, insurance companies, and investment firms.

- Stringent Risk Management: Requires the implementation of robust risk management processes to identify, protect, detect, respond, and recover from ICT-related disruptions and threats.

- Mandatory Testing and Audits: Financial entities must conduct regular testing and audits to assess their resilience against cyber threats.

- Enhanced Incident Reporting: Obliges firms to report major cyber incidents to competent authorities promptly.

- ICT Third-Party Risk Management: Includes provisions for managing risks posed by third-party ICT service providers.

Impact on Financial Entities in the EU

Financial entities in the EU must adhere to DORA's requirements, enhancing their capabilities to withstand and recover from ICT-related disruptions. This involves reassessing and strengthening their risk management frameworks, incident response plans, and relationships with ICT service providers.

Example: A European bank must ensure its digital infrastructure, including online banking platforms, complies with DORA's rigorous risk management and incident reporting standards, enabling rapid response and recovery in the event of a cyber incident.

Utilizing SBOM Observer for DORA Compliance

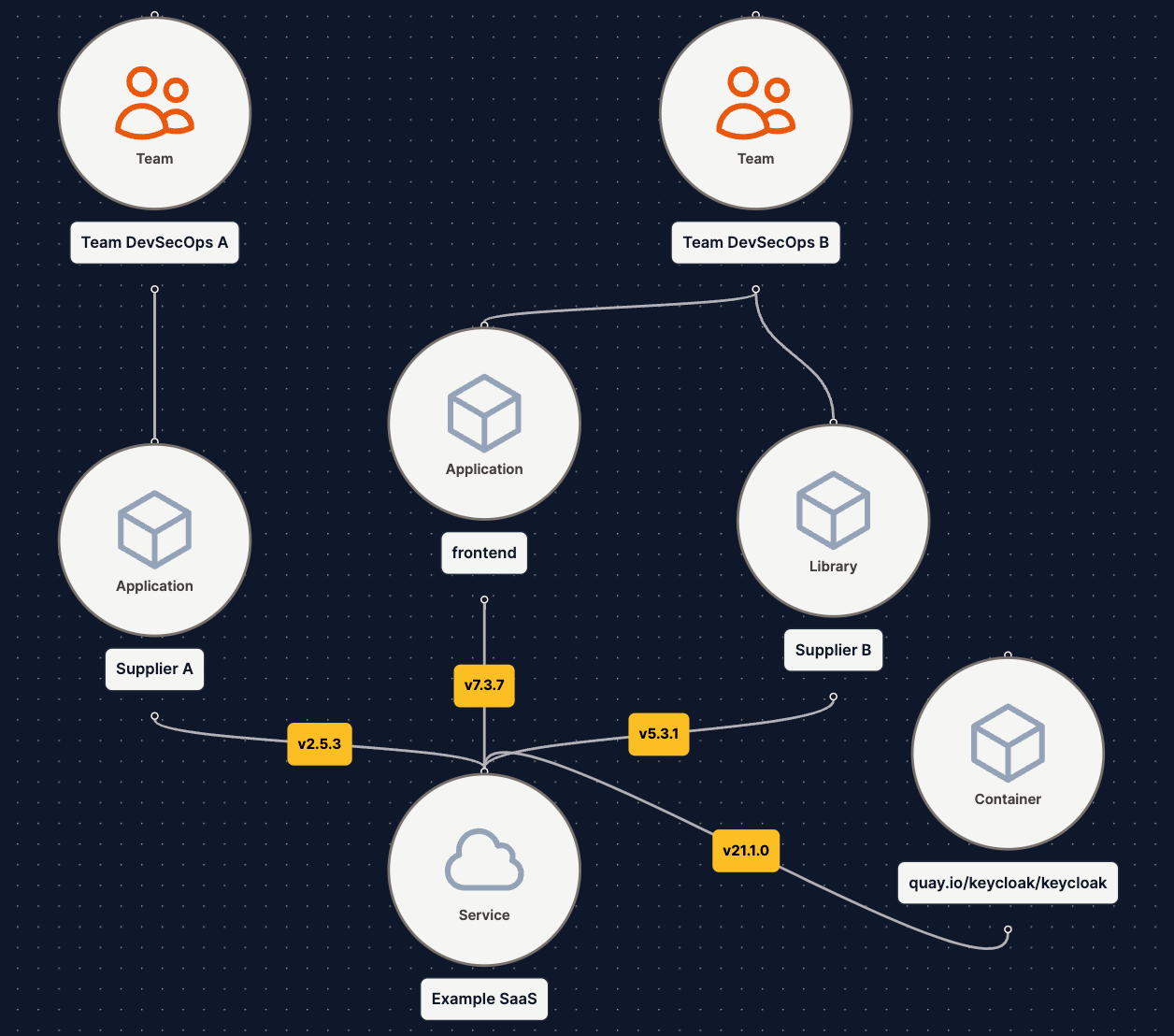

The Software Bill of Materials (SBOM) Observer is a valuable tool for financial entities to align with DORA's requirements, particularly in managing ICT third-party risks.

Role of SBOM Observer in DORA Compliance:

- Enhanced Transparency: Provides comprehensive visibility into software components used by financial entities, aiding in the identification of potential vulnerabilities.

- Third-Party Risk Management: Assists in assessing and managing risks associated with third-party software providers, a key aspect of DORA.

- Facilitating Compliance: By ensuring detailed documentation of software components, the SBOM Observer helps entities meet DORA's stringent requirements for ICT risk management.

By integrating the SBOM Observer into their operational resilience strategies, financial entities can better navigate the complexities of DORA compliance, ensuring a more secure and resilient financial ecosystem.

Guidance and Resources

Various EU regulatory bodies provide guidance to assist financial entities in complying with DORA.

Useful Links:

- EUR-Lex - DORA

- Introducing the Digital Operational Resilience Act | PwC

- Digital Operational Resilience Act (DORA) | KPMG

DORA marks a significant advancement in fortifying the cybersecurity and operational resilience of the EU's financial sector. By establishing comprehensive standards and requiring rigorous risk management and incident response protocols, it plays a pivotal role in protecting the financial ecosystem from the growing intensity of cyber threats.

Hands-on: Effective Management of Supplier Transparency

Step-by-Step Guide

SBOM Observer offers powerful capabilities for managing supplier transparency, essential for adhering to regulatory compliance requirements.

For practical steps on implementing these processes within your organization, refer to our guide: Implementing Supplier Transparency.